The fee structure is not listed on the company website and customer service representatives will not disclose it over the phone. You won't get a lot of frills with The Check Cashing Store - indicated by the name - but you will be able to deposit checks on your mobile device and send the money to a linked Visa, Mastercard, or Discover card.

Premium Plan (150 checks): $1.25 per check The Check Cashing Store: Most Simple App.Basic Plan (20 checks): $1.75 per check.With AnytimeCheck, business owners can get paid by customers by paper check without having to wait for the mail or visiting their bank to make a deposit. Up to 50% discount on FDA-approved pharmaceuticals AnytimeCheck: Best for Businesses.4% or $5 fee for all other checks (whichever is greater).1% or $5 fee for payroll or government checks (whichever is greater).

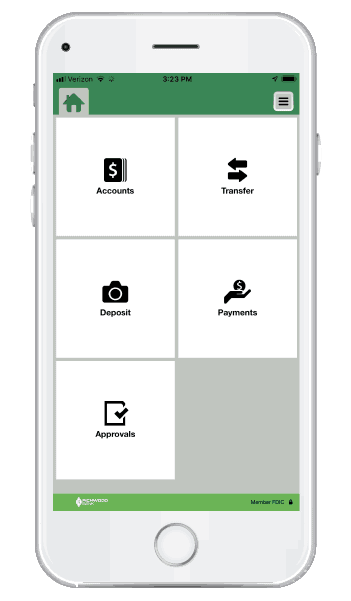

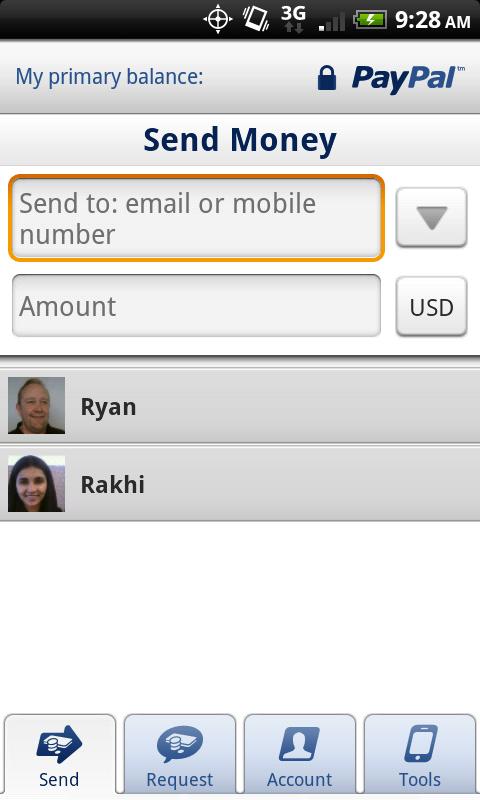

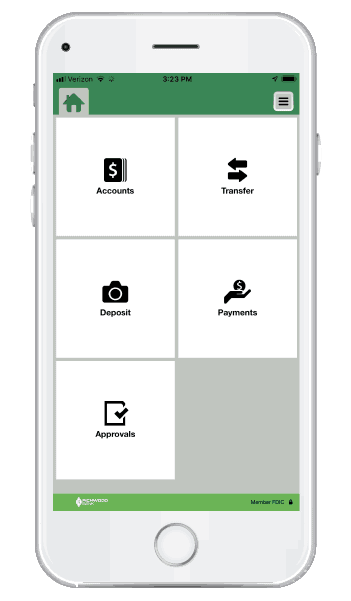

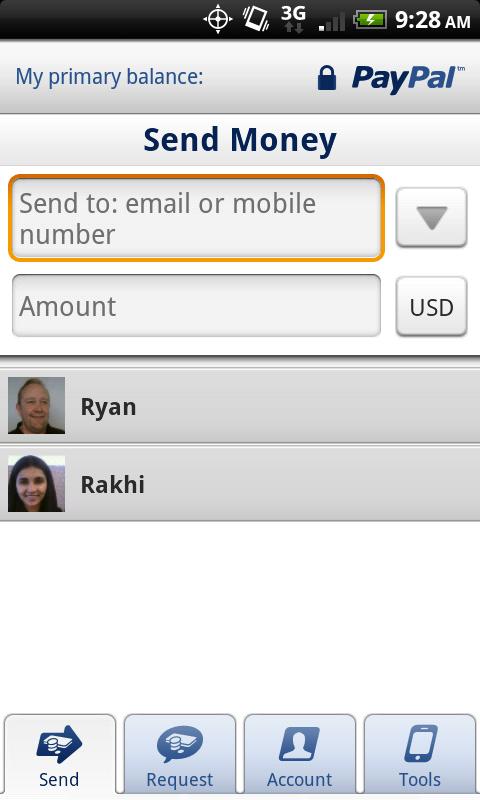

4.0 stars on Google Play Store | 2.7 stars on App Store. However, customers can receive sizable discounts on prescription purchases on FDA-approved pharmaceutical medication with the Pharmacy Savings Card. Netspend, provided through Ingo, offers a fairly standard fee structure. 2-5% expedited check cashing fee NetSpend: Best for Prescription Purchases. Fee-free cash withdrawals at 950 ACE locations in 23 U.S. 3.9 stars on Google Play Store | 2.7 stars on App Store. With an optional ACE savings account, you can even earn an absurd 6.0% APY on balances under $2,000. However, this is 100% a check-cashing app.ĪCE uses First Century Bank, N.A. Provided through MetaBank, ACE Flare provides many of the same services you can receive at a traditional bank, such as check cashing, ATM access, a Visa debit card, and direct deposit. If you've enrolled in Debit Card Coverage, everyday debit card purchases like groceries, may be approved at our discretion when you don't have enough money in your account.ĪCE Flare: Best Nontraditional Bank Account Chase may pay, for a $34 fee, overdraft transactions at our discretion based on your account history, deposits and transaction amount. *We won't charge an overdraft fee if you are overdrawn $50 or less at the end of the business day. Chase Overdraft Assist℠ - no overdraft fee if you're overdrawn by $50 or less at the end of the business day or if you're overdrawn by more than $50 and bring your account balance to overdrawn by $50 or less at the end of the next business day*. Available online nationwide except in Alaska, Hawaii and Puerto Rico. Chase Mobile® app - Manage your accounts, deposit checks, transfer money and more - all from your device. Access to 16,000 Chase ATMs and more than 4,700 branches. New Chase checking customers enjoy a $200 bonus when you open a Chase Total Checking® account and set up direct deposit.

0 kommentar(er)

0 kommentar(er)